how to count leverage forex

Broker A - 50 pips x 03 lots -150. For each margin percentage multiply 1 2 by the size of the trade.

Therefore multiply the margin by.

. Select the position size units you want to open. As a result leveraged trading can be a double-edged sword in that both potential profits as well as potential. Leverage on Forex brokers.

If the margin is 002 then the margin percentage is 2 and leverage 1 002 100 2 50. Broker B - 50 pips x 2 lots -1000. Choose your deposit currency.

To measure the leverage for trading - just use the below-mentioned leverage formula. Lets say that the GBPJPY is at 115 your unit of 50000 will turn into 57500 50000115. Below is a typical example of how to calculate leverage using the above formulas.

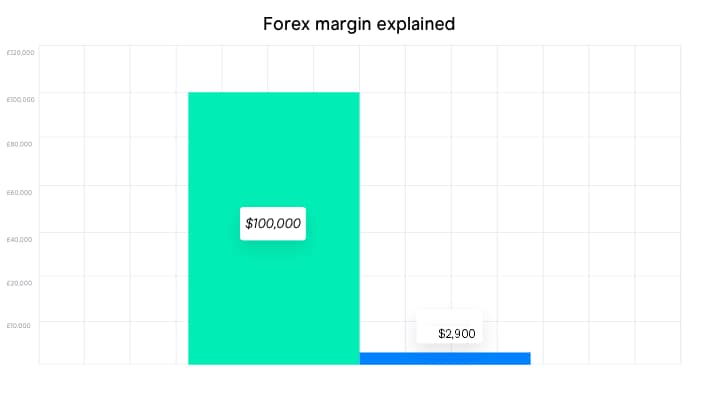

With -20pips on the position your account will lose only 20. Without leverage in forex trading opening a 1 lot trade 100000 units would require a trader to invest around 127000. To calculate the amount of margin used multiply the size of the trade by the margin percentage.

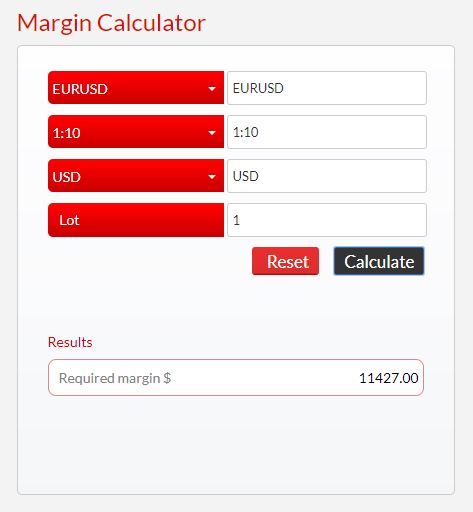

The answer is 20. To use the calculator follow the steps below. How to Calculate Leverage in Forex.

127000 500 leverage used 25400 required capital. The margin for opening a position is calculated by the formula. Add your leverage ratio.

Broker B 50 pips x 2 lots 1000 profit. Using a leverage level of 5001 we can dramatically reduce the amount of capital required. How to calculate margin in forex with Leverage Formula Invest Diva.

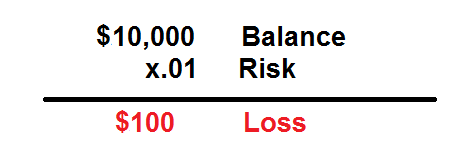

If the margin percentage is 2 for each margin percentage of 1 2 the margin percentage is 15. L is leverage E is margin amount and A is assets value. If you have 100 dollars then you can trade with a 1000 dollars trade.

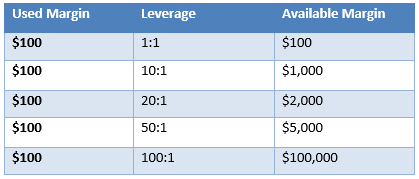

To calculate the amount of margin used just use our Margin Calculator. Using this leverage size we can use a simple formula to calculate. In the case of 501 leverage or 2 margin required for example 1 in a trading account can control a position worth 50.

Insert the current price of the asset or leave it at market price Click Calculate. For example to control a 10000 position your broker will set aside 100 from your account. HttpbitlyIT-forex-demo3Continue your trading education.

Leverage-adjusted margin Trade volume Contract size Price Margin percentage 100. How To Calculate Leverage In Forex Trading. The concept of notional value.

101 Ten to one leverage means that for every 1 you have in your account you can place a position worth up to 10. To calculate leverage simply divide the trade size by the required equity. You can start out using the margin amount using the leverage ratio to determine positions dimensions.

Yet even this is too much for 200 investment because losing 110 of the investment just in one trade means than. Similarly forex leverage means controlling a large amount of money in currency trading by borrowing from brokers. Leverage trade size equity.

Leverage is simply borrowed funds that traders use to trade. Traders are drawn to the Forex for many reasons including. 10 000 units of currency one mini contract on USDJPY with a trade size equal to 10 000 Margin percentage.

It is placed here for reference. However novice traders often forget that the fees will be much higher when using high leverage. Leverage in forex is a useful financial tool that allows traders to increase their market exposure beyond the initial investment deposit.

Using all the formulas illustrated above and the data supplied the Forex Margin Calculator tell us that to open a trade position long or short of a 010 lot EURUSD with a 301 leverage trading account and with the current EURGBP exchange rate of 090367 we would need a margin of 30122. Example of leverage. If the margin is 002 then the margin percentage is 2 and the leverage 1002 1002 50.

Leverage 1Margin 100Margin Percentage. For some traders looking for forex brokers that offer maximum leverage to get more profit potential. In other words it refers to the ability that traders have when opening an account with a forex broker to borrow funds in order to trade with a bigger amount than what they have initially deposited in their trading account.

The margin percentage fixed amount is the leverage provided by the broker when trading metals. Practice trading with a free demo trading account. For example for trading 03 lots you will likely pay anywhere between 15 and 3 in commissions while 2 lots will cost.

By using leverage you will add power to your initial capital. 500 in forex trading means that traders use every 1 with the possibility of earning as much as 500 in each transaction. Ad Empowering FX Traders In The Worlds Largest Traded Market For Over 20 Years.

Based on the data we have just been through we know the ideal leverage to trade Forex is 101 or 51. Of course this becomes an advantage of forex trading. Also this 20 will already include the spread paid.

Select your instrument eg. The forex leverage formula calculation is. Keeping Profit Target at Constant.

Open An Account And Start Trading Forex Like A Pro Today With The 1 US FX Broker. In this way they gain a larger exposure. 501 The fifty-one leverage is that you can trade 50 per each dollar you have in your account balance.

Leverage simply allows traders to control larger positions with a smaller amount of actual trading funds. How to calculate leverage in a Forex trading account. L A E.

Subtracting the margin used for all trades from the remaining equity in your account yields the amount of margin that you have left. To open a position traders invest none or a small amount of money. Now if you open 1 mini-lot of 10 000 units then youll be risking 1 for each pip.

How much leverage we can use.

The Relationship Between Margin And Leverage Babypips Com

Elliott Wave Cheat Sheet All You Need To Count In 2022 Wave Theory Waves Elliott

Create And Use A Trading Journal Stock Trading Strategies Trading Forex

How To Trade A Leading Diagonal Pattern In Elliott Wave Theory In 2022 Wave Theory Pattern Education

How To Calculate The Perfect Forex Position Size Vpt

Forex Calculators Margin Lot Size Pip Value And More Forex Training Group

What Is Leverage How Leverage Works Forex Com

The Relationship Between Margin And Leverage Babypips Com

How To Determine Lot Size For Day Trading

Audusd D1 Chart Future Analysis Long Term Call Buy At 0 71760 Or Bellow T P 0 75810 S L 0 68140 Gain 405pips Lose Forex Brokers Forex Forex Strategy

Pin On Best Forex Trading Strategy

Forex Trading For Beginners Full Course Youtube Forex Trading Forex Mentorship Program

What Is Margin In Forex Trading Cmc Markets

How To Consider Elliott Wave Alternative Count Wave Theory Forex Signals Forex

Leverage Formula How To Calculate Leverage In Forex Invest Diva

/Courses-Currency-Pairs-Stock-Exchange-Forex-643727-569a829c8446483b945ca8fd1c05e320.jpg)